-

Table of Contents

“Boost your financial future with these simple steps to improve your credit score in the UK.”

Introduction

Having a good credit score is essential for financial stability and success in the UK. It can affect your ability to get a loan, rent an apartment, or even secure a job. If you’re looking to improve your credit score, there are several steps you can take to achieve this goal. In this guide, we will discuss some tips and strategies to help you improve your credit score in the UK. By following these steps, you can take control of your credit and pave the way for a brighter financial future.

5 Simple Steps to Boost Your Credit Score in the UK

Having a good credit score is crucial in the UK, as it determines your eligibility for loans, credit cards, and even rental agreements. A credit score is a numerical representation of your creditworthiness, and it is used by lenders to assess the risk of lending you money. A higher credit score indicates that you are a responsible borrower, while a lower score may make it difficult for you to access credit or may result in higher interest rates. If you are looking to improve your credit score in the UK, here are five simple steps that can help you achieve that goal.

1. Check Your Credit Report

The first step to improving your credit score is to know where you stand. You can request a free credit report from any of the three credit reference agencies in the UK – Experian, Equifax, and TransUnion. Your credit report contains information about your credit history, including any missed or late payments, outstanding debts, and credit applications. It is essential to review your credit report regularly to ensure that all the information is accurate and up-to-date. If you find any errors, you can dispute them with the credit reference agency to have them corrected.

2. Make Payments on Time

One of the most significant factors that affect your credit score is your payment history. Lenders want to see that you can manage your debts and make payments on time. Late or missed payments can significantly impact your credit score, so it is crucial to pay your bills on time. Set up direct debits or reminders to ensure that you do not miss any payments. If you have any outstanding debts, make a plan to pay them off as soon as possible. This will not only improve your credit score but also save you money on interest charges.

3. Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you are using compared to your credit limit. A high credit utilization ratio can negatively impact your credit score. It is recommended to keep your credit utilization below 30% of your credit limit. For example, if you have a credit card with a limit of £1000, try to keep your balance below £300. If you have multiple credit cards, try to spread out your balances instead of maxing out one card. This shows lenders that you are responsible with your credit and can manage it effectively.

4. Avoid Opening Too Many Credit Accounts

While having a mix of credit accounts can be beneficial for your credit score, opening too many accounts in a short period can have a negative impact. Every time you apply for credit, it leaves a mark on your credit report, known as a hard inquiry. Too many hard inquiries can make you appear desperate for credit, which can be a red flag for lenders. It is best to only apply for credit when you need it and avoid opening multiple accounts at once.

5. Be Patient and Persistent

Improving your credit score takes time and effort, so it is essential to be patient and persistent. It may take a few months or even years to see a significant improvement in your credit score. However, by following the steps mentioned above and being consistent with your payments, you can gradually improve your credit score. It is also crucial to avoid any negative credit behaviors, such as missing payments or defaulting on loans, as these can have a long-lasting impact on your credit score.

In conclusion, having a good credit score is essential in the UK, and it requires effort and discipline to improve it. By regularly checking your credit report, making payments on time, keeping your credit utilization low, avoiding opening too many credit accounts, and being patient and persistent, you can boost your credit score and improve your financial standing. Remember, a good credit score not only makes it easier for you to access credit but also saves you money in the long run.

Understanding the Factors that Affect Your Credit Score in the UK

Having a good credit score is crucial in the UK, as it determines your eligibility for loans, credit cards, and even rental agreements. A credit score is a numerical representation of your creditworthiness, and it is used by lenders to assess the risk of lending you money. The higher your credit score, the more likely you are to be approved for credit and at better interest rates. In this article, we will discuss the factors that affect your credit score in the UK and how you can improve it.

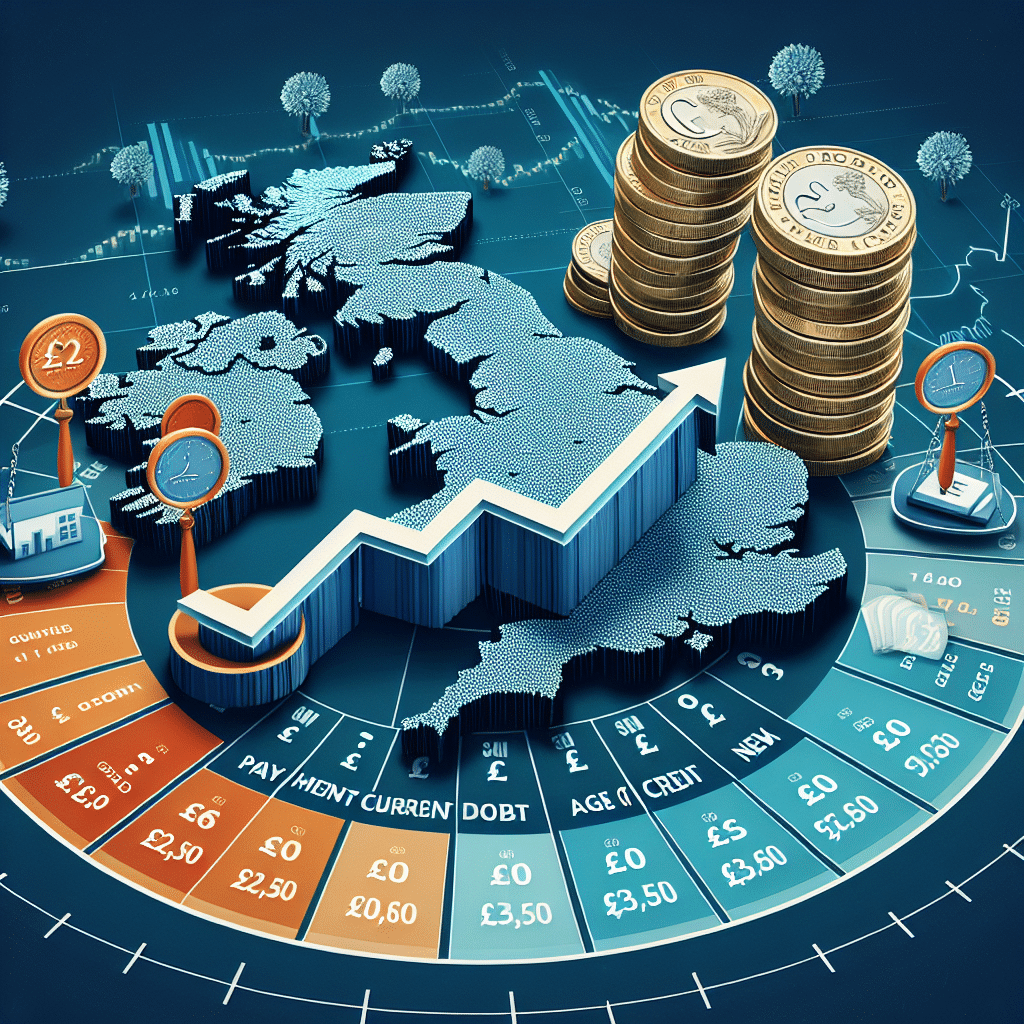

Payment history is the most significant factor that affects your credit score. It accounts for 35% of your overall score. Lenders want to see that you have a history of making timely payments on your credit accounts. Any missed or late payments can significantly lower your credit score. Therefore, it is essential to pay your bills on time, including credit card payments, loan repayments, and utility bills.

The amount of debt you owe is another crucial factor that affects your credit score. It accounts for 30% of your overall score. Lenders want to see that you are not overextended and can manage your debt responsibly. The amount of debt you owe is measured by your credit utilization ratio, which is the percentage of your available credit that you are using. It is recommended to keep your credit utilization ratio below 30%. For example, if you have a credit card with a limit of £10,000, you should aim to keep your balance below £3,000.

The length of your credit history also plays a significant role in determining your credit score. It accounts for 15% of your overall score. Lenders want to see that you have a long history of managing credit responsibly. Therefore, it is essential to keep your oldest credit accounts open, even if you are not using them. Closing old accounts can shorten your credit history and lower your credit score.

The types of credit you have also affect your credit score, accounting for 10% of your overall score. Lenders want to see that you have a mix of different types of credit, such as credit cards, loans, and mortgages. Having a diverse credit portfolio shows that you can manage different types of credit responsibly.

Lastly, new credit applications can also impact your credit score. It accounts for 10% of your overall score. Every time you apply for credit, a hard inquiry is made on your credit report, which can lower your credit score. Therefore, it is essential to limit the number of credit applications you make, especially within a short period. It is also crucial to note that checking your own credit score does not affect your credit score.

Now that you understand the factors that affect your credit score let’s discuss how you can improve it. The first step is to check your credit report regularly. You are entitled to a free credit report from each of the three credit reference agencies in the UK – Experian, Equifax, and TransUnion. Review your report for any errors or discrepancies and report them immediately. These errors can significantly impact your credit score, so it is crucial to have them corrected.

Next, make sure to pay your bills on time. Set up automatic payments or reminders to ensure you do not miss any payments. If you have any outstanding debts, work on paying them off as soon as possible. Reducing your debt can significantly improve your credit score.

Another way to improve your credit score is to keep your credit utilization ratio low. If you have high balances on your credit cards, consider paying them off or transferring them to a card with a lower interest rate. This will not only improve your credit score but also save you money on interest payments.

In conclusion, understanding the factors that affect your credit score is crucial in improving it. By paying your bills on time, keeping your debt levels low, maintaining a long credit history, having a diverse credit portfolio, and limiting new credit applications, you can improve your credit score in the UK. Remember to regularly check your credit report and take steps to correct any errors. With a good credit score, you can have better financial opportunities and peace of mind.

The Dos and Don’ts of Managing Your Credit to Improve Your Score in the UK

Having a good credit score is crucial in the UK, as it determines your eligibility for loans, credit cards, and even rental agreements. A high credit score not only makes it easier to access credit, but it also allows you to secure better interest rates and terms. On the other hand, a low credit score can limit your financial options and make it difficult to achieve your financial goals. If you’re looking to improve your credit score in the UK, here are some dos and don’ts to keep in mind.

Do: Check Your Credit Report Regularly

The first step to improving your credit score is to know where you stand. In the UK, you can access your credit report for free from three main credit reference agencies: Experian, Equifax, and TransUnion. It’s important to check your credit report regularly to ensure that all the information is accurate and up-to-date. If you spot any errors or discrepancies, you can dispute them with the credit reference agency to have them corrected.

Don’t: Miss Payments

One of the most significant factors that affect your credit score is your payment history. Missing payments or making late payments can have a negative impact on your credit score. It’s crucial to make all your payments on time, whether it’s for credit cards, loans, or utility bills. If you’re struggling to make payments, it’s best to contact your creditors and discuss alternative payment arrangements.

Do: Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you’re using compared to your credit limit. It’s recommended to keep your credit utilization below 30% to maintain a good credit score. For example, if you have a credit card with a limit of £5,000, try to keep your balance below £1,500. High credit utilization can signal to lenders that you’re relying too heavily on credit, which can be seen as a red flag.

Don’t: Apply for Multiple Credit Accounts at Once

When you apply for credit, the lender will perform a hard inquiry on your credit report, which can temporarily lower your credit score. If you apply for multiple credit accounts within a short period, it can have a significant impact on your credit score. It’s best to space out your credit applications and only apply for credit when you need it.

Do: Diversify Your Credit

Having a mix of different types of credit can positively impact your credit score. This includes credit cards, loans, and even a mortgage. Lenders like to see that you can manage different types of credit responsibly. However, it’s essential to only take on credit that you can comfortably afford to repay.

Don’t: Close Old Credit Accounts

Closing old credit accounts may seem like a good idea, but it can actually harm your credit score. This is because it reduces the length of your credit history, which is another factor that affects your credit score. If you have old credit accounts that you no longer use, it’s best to keep them open and use them occasionally to keep them active.

Do: Be Patient

Improving your credit score takes time, and there are no quick fixes. It’s essential to be patient and consistent with your efforts to improve your credit. By following the dos and don’ts mentioned above, you can gradually see an improvement in your credit score over time.

In conclusion, managing your credit responsibly is key to improving your credit score in the UK. By regularly checking your credit report, making payments on time, keeping your credit utilization low, and being patient, you can gradually see an increase in your credit score. Remember to avoid applying for multiple credit accounts at once and to keep old credit accounts open to maintain a healthy credit history. With these dos and don’ts in mind, you can take control of your credit and improve your financial standing in the UK.

Conclusion

In conclusion, improving your credit score in the UK is a crucial step towards financial stability and access to better financial opportunities. By understanding your credit report, making timely payments, and managing your credit utilization, you can gradually improve your credit score. It is also important to regularly check your credit report for any errors and take steps to correct them. With patience and responsible financial habits, you can see a significant improvement in your credit score over time. Remember, a good credit score can open doors to better interest rates, loan approvals, and overall financial well-being.